Brigit: Cash Advance & Credit

4.8

Download

Download from Google Play Download from App StoreUnknown

Have you ever found yourself in a tight financial spot, praying for payday to arrive sooner? Well, I've been there, and let me tell you, Brigit: Cash Advance & Credit might just be the lifesaver you didn’t know you needed. I recently took this app for a spin, and here's the lowdown on how it can ease your financial stress.

Getting to Know Brigit

First things first, let's talk about what Brigit actually does. At its core, Brigit is designed to provide you with quick cash advances and help you manage your credit better. It's like having a financial buddy who’s got your back when unexpected expenses hit. The app is available on both Android and iOS, so no worries if you're team Apple or team Android.

How Does It Work?

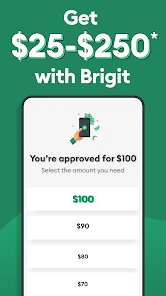

Setting up Brigit is a breeze. After downloading the app, you’ll need to link your bank account. Don’t worry, it’s all secure and encrypted. Once that's done, Brigit analyzes your spending habits and account activity to predict when you might need a little financial boost. The app then offers cash advances up to $250 without any interest or hidden fees. That's right, no interest! Just a flat membership fee if you choose to upgrade to the Plus plan.

One of the coolest features is the automatic cash advance option. Imagine this: you're about to overdraft, and Brigit swoops in to save the day by automatically sending funds to your account. It’s like a financial superhero in your pocket!

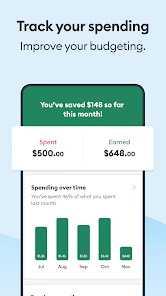

Credit Building and Financial Insights

Aside from cash advances, Brigit also offers a nifty credit builder feature. This is perfect if you're looking to improve your credit score. It reports to all three major credit bureaus, which is essential for building a solid credit history. Plus, the app gives you detailed insights into your spending habits, helping you make more informed financial decisions.

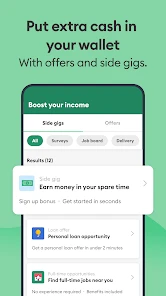

Brigit isn't just about throwing money at you. It’s about empowering you to take control of your finances. The app provides personalized financial tips and budgeting tools, which are super handy if you're trying to get your financial life in order.

My Personal Take

In my experience, using Brigit felt like having a safety net for those "just in case" moments. It's straightforward, user-friendly, and offers peace of mind knowing that if something unexpected comes up, you have a fallback option. The credit building aspect is an added bonus that can be a game-changer for anyone looking to boost their credit score over time.

However, it's worth mentioning that Brigit might not be for everyone. If you're looking for large sums of cash, this isn't the app for that. But if you need a little cushion until payday, it's absolutely worth considering.

So, if you're living paycheck to paycheck and need a bit of financial breathing room, give Brigit: Cash Advance & Credit a try. It might just be the financial friend you’ve been searching for.