Current: The Future of Banking

4.5

Download

Download from Google Play Download from App StoreUnknown

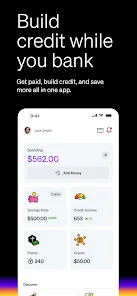

Hey there, fellow app enthusiasts! Let me take you on a journey through the world of Current: The Future of Banking, an app that’s been making waves in the financial tech scene. If you’re like me and always on the lookout for ways to manage money more efficiently, then this app might just be your new best friend.

Getting Started with Current

First things first, setting up Current: The Future of Banking is as easy as pie. You just download it from your app store, sign up, and voilà, you’re in. The user interface is sleek and intuitive, which makes navigation a breeze. I was pleasantly surprised at how quickly I could link my bank accounts and start tracking my spending habits.

Features That Stand Out

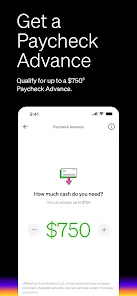

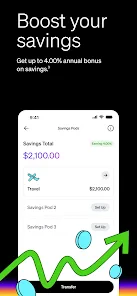

One of the features that caught my eye immediately was the budgeting tool. It allows you to set weekly or monthly spending limits, helping you curb those impulse buys. Plus, there’s a nifty feature that rounds up your purchases to the nearest dollar and saves the difference. It's like having a digital piggy bank that fills up without you even realizing it!

Another standout feature is the instant notifications. Every time there’s a transaction on your account, you get alerted. It’s reassuring to have that kind of oversight and helps in quickly spotting any suspicious activity.

Security and Peace of Mind

Now, let’s talk about security because, let’s face it, in today’s world, that’s a biggie. Current: The Future of Banking uses state-of-the-art encryption to keep your data safe. And if you ever lose your card, you can lock it with just a tap. I’ve tried it, and it works seamlessly, giving you peace of mind when you need it the most.

Moreover, the app offers a feature where you can generate virtual cards for online shopping. This adds an extra layer of security, which I find incredibly useful, especially with all the online shopping I do!

Customer Support and Community

One aspect that often gets overlooked but is crucial is customer support. With Current, you can chat with a support agent directly through the app. I tested it out with a few questions and found the responses to be quick and helpful. It’s like having a bank representative in your pocket.

Plus, there’s an active community of users who share tips and tricks on getting the most out of the app. It’s always great to be part of a community that’s as passionate about financial wellness as you are.

All in all, if you’re searching for a banking app that’s modern, secure, and user-friendly, give Current a try. It’s packed with features that not only help you manage your money but also ensure you’re doing so in the safest way possible. So, what are you waiting for? Dive into the future of banking with Current today!