EveryDollar: Budget Planning

4.3

Download

Download from Google Play Download from App StoreUnknown

When it comes to managing finances, having the right tools can make all the difference. Enter EveryDollar: Budget Planning, an app designed to help you track your spending and manage your budget with ease. I’ve had the chance to delve into its features, and here’s my take on it.

Getting Started with EveryDollar

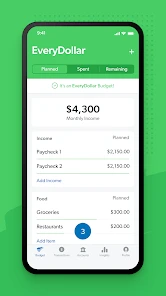

First things first, setting up EveryDollar is a breeze. The app is available for both Android and iOS, making it accessible to a wide range of users. Once you download it, the interface greets you with a clean, intuitive design. You don’t have to be a financial expert to navigate through it, which is a major plus. The onboarding process is straightforward, guiding you through creating your first budget in just a few steps.

Features That Stand Out

One of the standout features of EveryDollar is its zero-based budgeting approach. This method ensures that every dollar you earn is assigned a purpose, hence the name. This strategy not only helps in keeping track of expenses but also encourages you to save more intentionally.

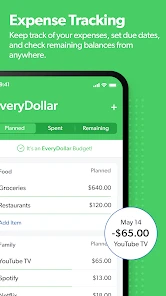

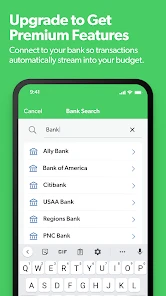

Another feature worth mentioning is the ability to customize categories. Whether you’re saving for a vacation, managing monthly bills, or just keeping track of daily expenses, you can tailor the app to fit your individual needs. Plus, it syncs across devices, so you’re always updated on your budget status, whether you’re at home or on the go.

Real-Life Application

I decided to put EveryDollar to the test over a month, and I must say, it’s been quite enlightening. The app allowed me to see where my money was going and helped me identify areas where I could cut back. For instance, I realized I was spending way too much on takeout. By identifying this pattern, I was able to adjust my habits and save a little extra for my travel fund.

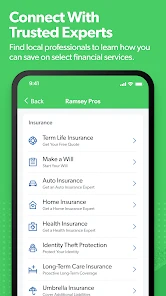

Furthermore, the app offers insights and tips to better manage finances, which is like having a mini financial advisor in your pocket. The user community is also quite active, providing support and sharing budgeting tips and tricks.

Final Thoughts

In conclusion, EveryDollar: Budget Planning is a fantastic tool for anyone looking to take control of their finances in a structured, user-friendly way. It’s not just about tracking expenses but also about changing your financial habits for the better. The app is well-suited for both budgeting newbies and seasoned savers alike. If you’re looking to give your financial health a boost, I’d highly recommend giving EveryDollar a try.

Remember, managing money doesn’t have to be a chore. With the right app, it can be an empowering and enlightening experience!