FloatMe: Budget & Cash Advance

4.6

Download

Download from Google Play Download from App StoreUnknown

If you’ve ever found yourself strapped for cash a few days before payday, you’re not alone. It’s a struggle many face, and it’s exactly where FloatMe: Budget & Cash Advance steps in. Designed for the everyday individual, this app promises to lend a helping hand when your wallet feels a bit light. Let’s dive into what makes this app a potential lifesaver.

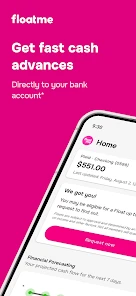

Getting to Know FloatMe

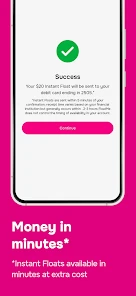

Imagine this: you’re out and about, and suddenly, you remember that bill you forgot to budget for. Panic sets in, right? Not anymore! With FloatMe: Budget & Cash Advance, you have access to small cash advances to cover those unexpected expenses. The app is straightforward and easy to use. After a quick setup process, you’re ready to request advances up to $50. It might not sound like much, but sometimes that’s all you need to keep things afloat.

Seamless Budgeting

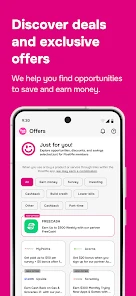

Beyond just cash advances, FloatMe also doubles as a budgeting tool. It helps you track your spending and manage your finances more effectively. The app syncs with your bank account and provides insights into your spending habits. This is where FloatMe shines, because, let’s face it, we could all use a little help in managing our money smarter. By getting a clear picture of where your money is going, you can make more informed financial decisions.

User Experience

One of the app’s significant strengths is its user-friendly interface. It’s designed for everyone, whether you’re tech-savvy or not. The navigation is intuitive, and everything you need is just a tap away. Notifications keep you updated on your balance and remind you when you’re eligible for another advance. Plus, there’s no need to worry about hidden fees or complicated terms—everything is laid out in plain sight.

Security and Peace of Mind

In today’s digital age, security is a top priority. FloatMe takes this seriously, employing bank-level encryption to keep your data safe. Knowing that your financial information is secure gives you peace of mind, allowing you to focus on what truly matters—whether that’s meeting friends for a coffee or paying that unexpected bill.

All in all, FloatMe: Budget & Cash Advance is like a trusty friend who’s got your back when you’re in a pinch. It’s not just about getting cash quickly; it’s about empowering you to manage your finances better. So, if you’re tired of living paycheck to paycheck and need a bit of breathing room, give FloatMe a shot. It might just be the financial sidekick you’ve been searching for.