Greenlight Kids & Teen Banking

4.7

Download

Download from Google Play Download from App StoreUnknown

Hey there, fellow parents! Today, I'm diving into an app that's been buzzing around in the parenting community - the Greenlight Kids & Teen Banking app. As a parent myself, I'm always on the lookout for tools that can make life simpler and teach my kids a thing or two about money. So, let's break it down!

What is Greenlight Kids & Teen Banking?

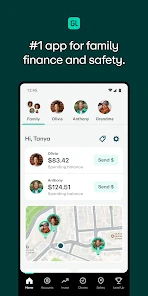

In a nutshell, Greenlight Kids & Teen Banking is a debit card for kids and teens that parents can manage from their phones. It's designed to teach kids financial responsibility while giving parents peace of mind. The app allows you to set up flexible spending controls, automate allowances, and even offers a feature for kids to earn money through chores. Sounds like a digital piggy bank on steroids, right?

Getting Started with Greenlight

Setting up was a breeze! After downloading the app, I signed up, and within minutes, I was setting up accounts for my kids. Each child gets their own card, and I can monitor and control their spending from the app. The interface is user-friendly, with bright colors and simple graphics that make navigating the app a piece of cake, even for tech-challenged parents like me!

Features that Stand Out

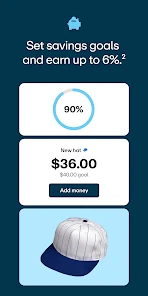

One feature I absolutely love is the spending controls. I can set specific spending limits for different categories like food, entertainment, and more. There's also a great feature that lets kids save towards a goal, which is a fantastic way to teach them about savings. Plus, the app sends real-time notifications of their spending, so you're always in the loop.

Another gem is the chore management feature. You can assign chores and tie them to allowances, which not only teaches kids the value of earning money but also gets them to do their share of household tasks. It's a win-win!

Learning and Growing with Greenlight

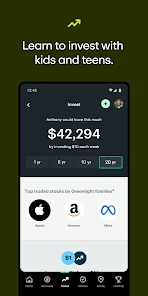

Education is key, and Greenlight does a good job of incorporating learning into its platform. The app includes a variety of educational resources and tools to help kids learn about money management. From setting up savings goals to understanding interest, it's like having a financial literacy class in your pocket.

Final Thoughts

All in all, I'm really impressed with Greenlight Kids & Teen Banking. It's more than just a banking app; it's a financial learning tool for kids and a management tool for parents. While there is a subscription fee, I think the value it provides in teaching kids about money is worth every penny. If you're looking for an easy and effective way to teach your kids about financial responsibility, give Greenlight a try. Trust me, you won't regret it!