SoLo Funds: Lend & Borrow

4.2

Download

Download from Google Play Download from App StoreUnknown

Hey friends, have you ever found yourself in that awkward situation where you’re just a bit short on cash and payday seems like it's forever away? Or maybe you’ve got a little extra money and you’re looking to help someone out while making a bit on the side? Well, let me introduce you to SoLo Funds: Lend & Borrow, an app that’s been making waves in the world of peer-to-peer lending.

What is SoLo Funds?

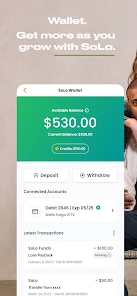

SoLo Funds is essentially a community-based platform where people can lend and borrow money without the hefty fees often associated with traditional financial institutions. Think of it as a way to support your neighbors, friends, or even strangers, while also getting the support you need.

Getting Started

Setting up the app is a breeze. You sign up, set your preferences, and you’re good to go. The app’s interface is super user-friendly, so even if technology isn’t your thing, you’ll find it simple to navigate. The whole process is designed to be as seamless as possible, which I absolutely loved. You know how some apps just feel like a chore to use? This isn’t one of them!

Lending and Borrowing Made Simple

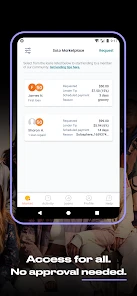

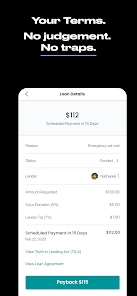

What I find really cool about SoLo Funds is how it personalizes the lending and borrowing process. As a borrower, you can set your terms and repayment date. And if you’re lending, you get to choose from various borrowers based on their request details and repayment capabilities. The flexibility here is fantastic because it allows both parties to find terms that truly work for them.

Plus, there’s a sweet feature where you can leave a tip for the platform if you wish, instead of paying mandatory interest. This makes the transactions feel more like a community effort rather than a business exchange.

Safety and Security

I know what you’re thinking – is it safe? The app has built-in protection measures to safeguard your information and transactions. It uses bank-level security and encryption, so you can rest easy knowing your data is in good hands. Moreover, they have a nifty feature called SoLo Score, which helps lenders evaluate the trustworthiness of borrowers, adding an extra layer of reassurance.

Community and Impact

One of the standout aspects of SoLo Funds is its community-driven ethos. The app doesn’t just focus on transactions; it emphasizes building a community where people genuinely help each other out. It’s this spirit of camaraderie that sets it apart from other lending apps. You’re not just lending or borrowing money; you’re part of something bigger.

And let’s not forget the impact. By using SoLo Funds, you’re potentially helping someone meet their urgent needs or supporting their goals, which is a great feeling. It’s like being a part of a grassroots movement aimed at financial empowerment.

In conclusion, if you’re looking for a way to manage short-term financial needs or simply want to help others while making a bit of return, I’d say give SoLo Funds a shot. It’s straightforward, secure, and community-focused. Plus, who doesn’t love an app that makes financial transactions feel personal and meaningful? Go check it out and see how it can work for you!